dallas county texas sales tax rate

Tax Office Past Tax Rates. The current total local sales tax rate in dallas tx is 8250.

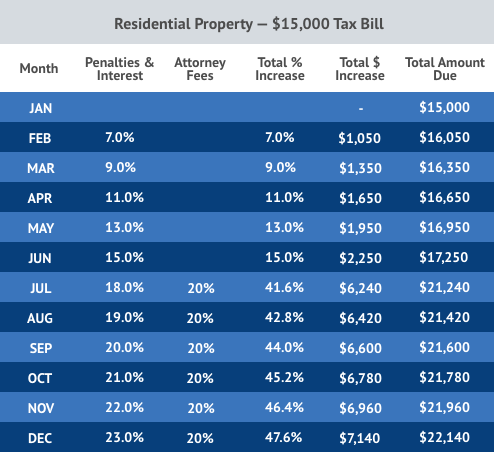

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

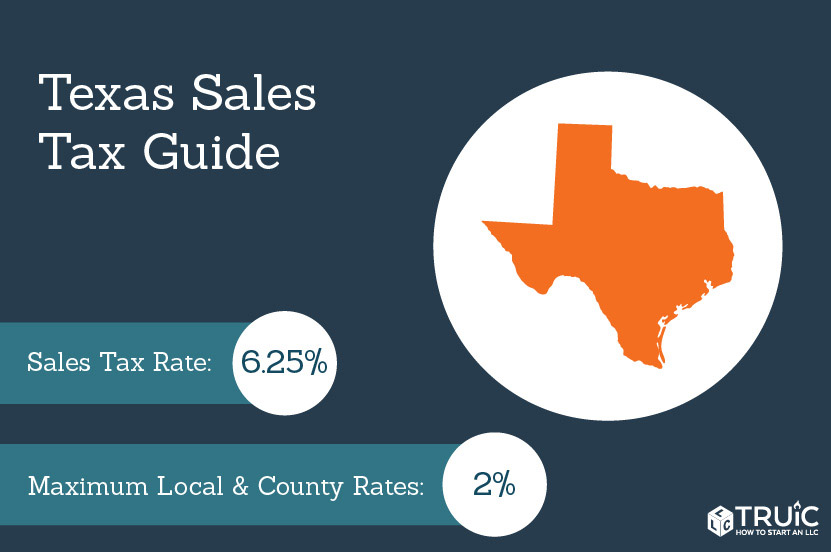

The Texas state sales tax rate is currently.

. Up to date 2022 Texas sales tax rates. 3 rows Dallas County TX Sales Tax Rate The current total local sales tax rate in Dallas. Estimated Combined Tax Rate 825 Estimated County Tax Rate 000 Estimated City Tax Rate 100 Estimated Special Tax Rate 100 and Vendor Discount 05 N.

Sales Tax and Use Tax Rate of Zip Code 75356 is located in Dallas City Dallas County Texas State. 2022 Tax Rates Estimated 2021 Tax Rates. 4104 Shorecrest Dr Dallas TX 75209 is listed for sale for 900000.

Texas residents 625 percent of sales price less credit for sales or use taxes paid to other states when bringing a motor vehicle into Texas that was purchased in another state. To review the rules in Texas visit our state-by-state guide. Texas has a 625 sales tax and Dallas County collects an additional NA so the minimum sales tax rate in Dallas County is 625 not including any city or special district taxes.

The Dallas Texas sales tax is 825 consisting of 625 Texas state sales tax and. Use our sales tax calculator or download a free Texas sales tax rate table by zip code. 2 State Sales tax is 625.

Local tax rates in Texas range from 0125 to 2 making the sales tax range in Texas 6375 to 825. Has impacted many state nexus laws and sales tax collection requirements. Lauras Income Tax Services El Monte.

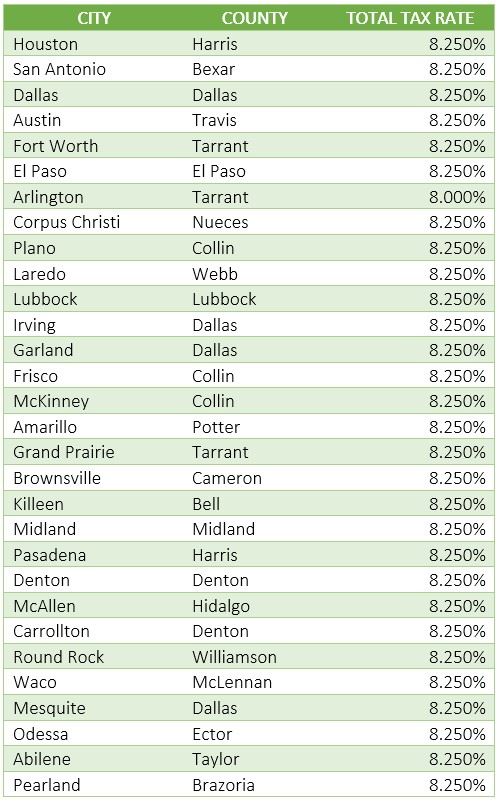

Texas has 743 seperate areas each with their own Sales Tax rates with the lowest Sales Tax rate in Texas being 625 and the highest Sales Tax rate in Texas at 825. The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax. 2 State Sales tax is 625.

The average cumulative sales tax rate between all of them is 825. The current total local sales tax rate in Dallas TX is. This is the total of state and county sales tax rates.

Name Local Code Local Rate TotalRate Name Local Code Local Rate TotalRate. This is the total of state county and city sales tax rates. As for zip codes there are around 138 of them.

Dallas Texas Sales Tax Rate - Learn the total rate of tax you must collect as a business in Collin Denton Kaufman and Rockwall counties - the base rate is 625 in Texas. Automating sales tax compliance can help your business keep compliant with. Texas has 2176 cities counties and special districts that collect a local sales tax in addition to the Texas state sales taxClick any locality for a full breakdown of local property taxes or visit our Texas sales tax calculator to lookup local rates by zip code.

The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. If you are buying a car for 2500000. Average Sales Tax With Local.

The total sales tax rate in any given location can be broken down into state county city and special district rates. If you need access to a database of all Texas local sales tax rates visit the sales tax data page. 4 rows Dallas.

The Texas state sales tax rate is currently. There is no applicable county tax. A full list of these can be found below.

Dallas Texas Auto Sales Tax Rate. While many counties do levy a countywide. The sales tax rate does not vary.

The most populous location in Dallas County Texas is Dallas. How Does Sales Tax in Dallas compare to the rest of Texas. Texas has recent rate changes Thu Jul 01 2021.

In Texas 123 counties impose a county sales and use tax for property tax relief. The combined sales tax rate for Dallas County TX is 725. The Dallas County sales tax rate is.

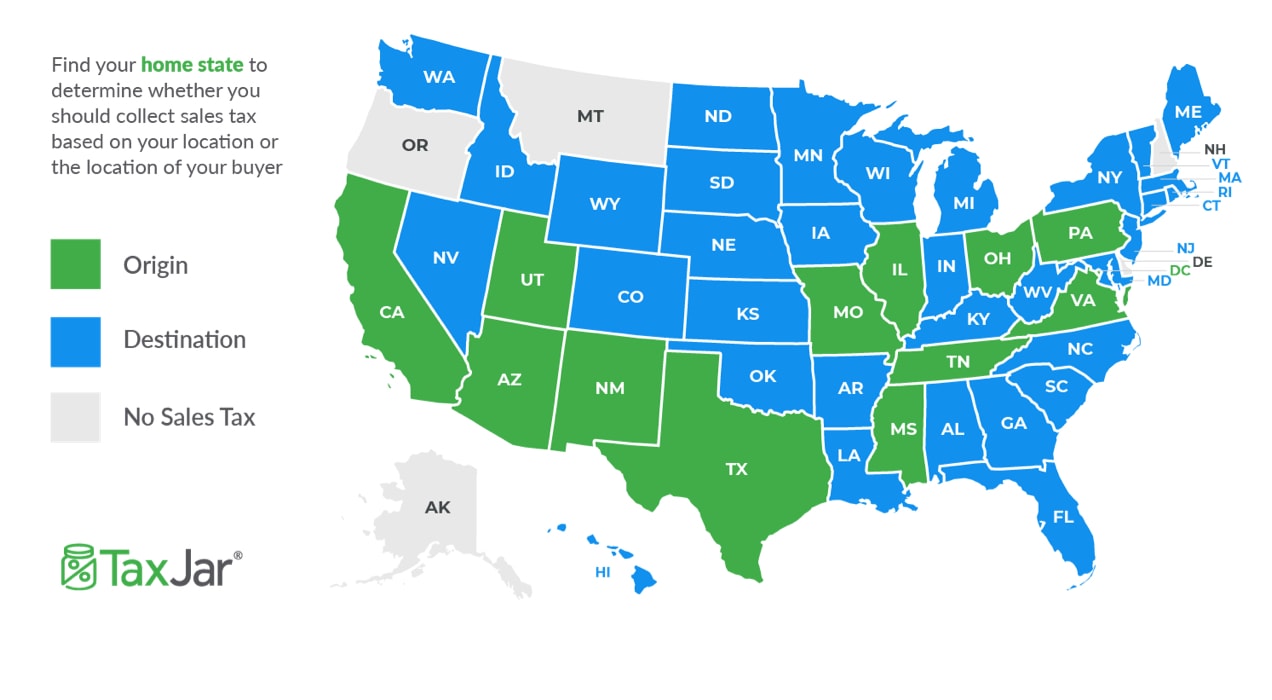

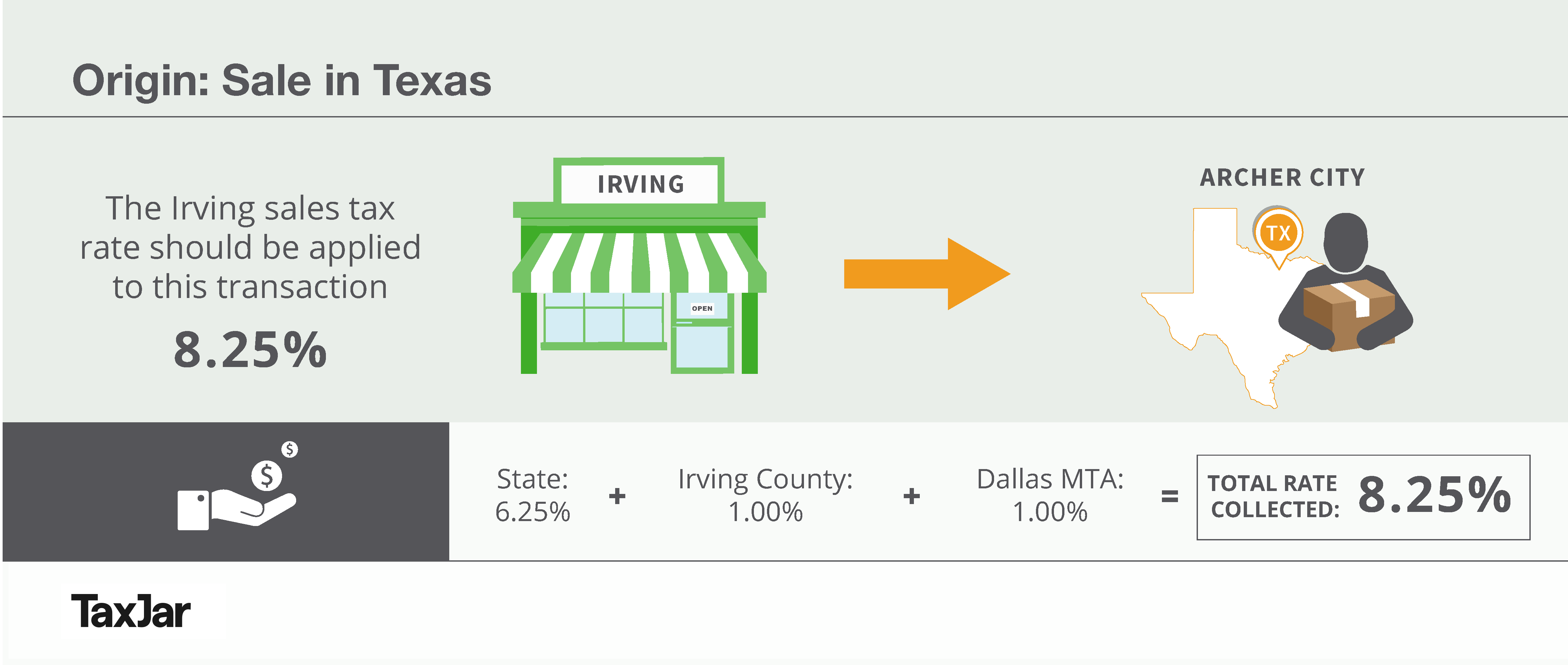

The 2018 United States Supreme Court decision in South Dakota v. Sales Tax in Dallas Texas is calculated using the following formula. Sales Tax and Use Tax Rate of Zip Code 75226 is located in Dallas City Dallas County Texas State.

You can print a 825 sales tax table here. TX Sales Tax Rate. The base Dallas Texas sales tax rate is 1 and the Dallas Texas sales tax rate Dallas MTA Transit is 1 so when combined with the Texas sales tax rate of.

AddisonDallas Co 2057217 010000 082500 Allentown 067500 DallasMTA 3057994 010000 AngelinaCo 4003007 005000 AdkinsBexar Co 082500 Alleyton 067500. 625 percent of sales price minus any trade-in allowance. How is Sales Tax Calculated in Dallas Texas.

Looking for Dallas County Election Information or Results. There is no applicable county tax. 214 653-7811 Fax.

The base state sales tax rate in Texas is 625. The Texas state sales tax rate is currently 625. Dallas County is located in Texas and contains around 21 cities towns and other locations.

Dallas Texas sales tax is a rate of tax a consumer must pay when purchasing goods and some services in Collin Denton Kaufman and Rockwall counties Texas and that a business must collect from their customers. Sales is under Consumption taxes. 33 rows Dallas County Has No County-Level Sales Tax.

TEXAS SALES AND USE TAX RATES April 2022.

How To Charge Your Customers The Correct Sales Tax Rates

Tax Information City Of Sachse Official Website

2021 2022 Tax Information Euless Tx

Texas Sales Tax Small Business Guide Truic

Texas Sales Tax Guide And Calculator 2022 Taxjar

How To File And Pay Sales Tax In Texas Taxvalet

Tax Rates Richardson Economic Development Partnership

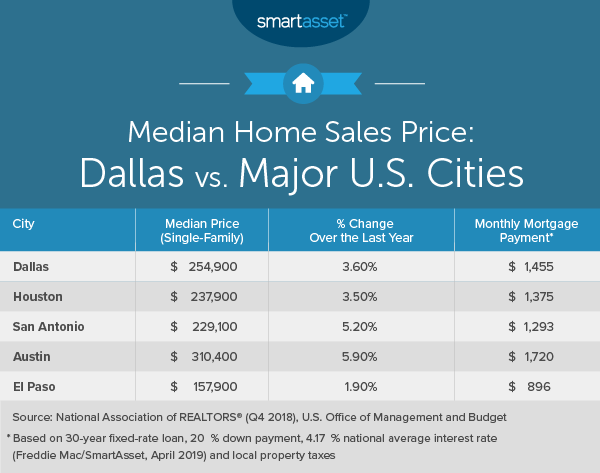

Cost Of Living In Dallas Smartasset

Texas Tax Group Inc Reviews Ratings Tax Services Near 4101 Mcewen Dallas Tx

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

How To Charge Your Customers The Correct Sales Tax Rates

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

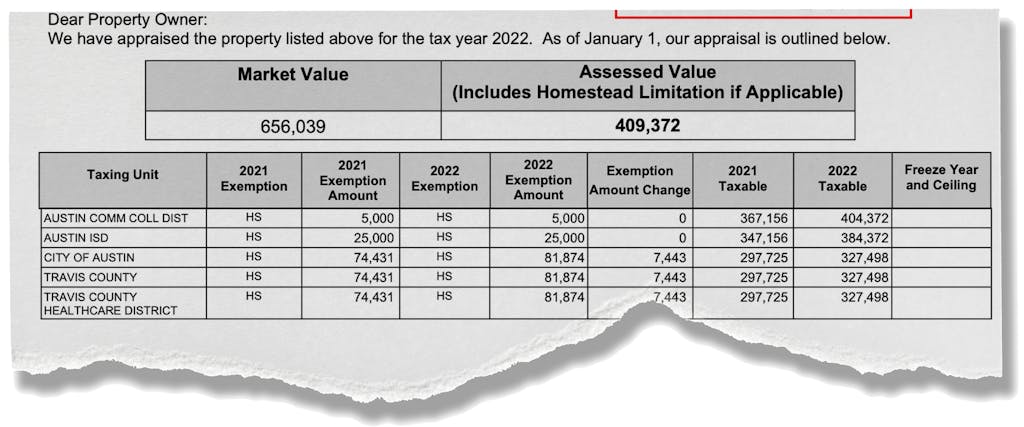

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Texas Sales Tax Guide For Businesses

Texas Sales Tax Rates By City County 2022

How To Charge Your Customers The Correct Sales Tax Rates

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity